Universal Insurance Holdings, after discontinuing more than 160,000 policies over the last two years, now sounds like it’s ready to start growing again in its home state of Florida.

“As we move forward, we’re more confident in the Florida market, which is our largest geography, and we have started to slowly increase new business in additional territories,” said Steve Donaghy, CEO of Universal and its main brand, Universal Property Insurance Co., one of Florida’s largest carriers.

And, thanks in part to Florida litigation legislation approved in the last year, Universal officials hope to actually see, wait for it … a potential decrease in rates in a state that has witnessed enormous jumps in premiums for almost all lines of business.

“The legislation has still not impacted our entire book of business, so as that flows through, we’re seeing a lot of positive development that I believe will be reflected in future years, and we can look at potential rate reductions in Florida,” Donaghy said.

Until now, many in the Florida insurance market have shied away from the “decrease” word on rates, despite the 2022 reform legislation that aimed to limit claims lawsuits, attorney fees and bad-faith claims against insurers. Some have predicted that Florida rates will never drop, but will only stabilize thanks to the new statutes.

Donaghy’s words came Friday in an earnings call that expanded on the publicly traded company’s third-quarter 2023 financial statement. The numbers continue to improve for the firm, with total revenue up $73 million over Q3 2021, a period that could be considered one of the darkest of the Florida property insurance crisis. Direct premiums written also have grown, from $433 million in Q3 2021, to $532 million this year.

Universal Insurance Holdings, based in Fort Lauderdale, is not yet in the black but net losses have continued to shrink, to just $6 million in the third quarter this year, a 98% improvement from losses seen a year ago at this time. And the combined ratio has improved significantly, down to 110.7%, a sharp decline from the 139.2% posted in Q3 of last year.

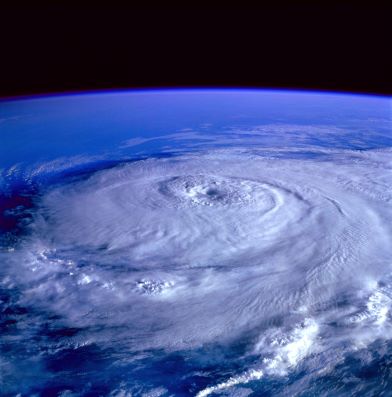

Weather losses have been manageable, company officials said. The company is sticking with its early estimate of $1 billion in losses from 2022’s Hurricane Ian, “and we feel good about that,” Donaghy added. And Hurricane Idalia, which hit part of Florida in late August of this year, was less severe than anticipated, allowing Universal to absorb the losses and stay within it reinsurance retention limits.

Universal’s claims adjusting firm, Alder Adjusting, generated a profit of almost $19 million in the third quarter 2023, Universal’s chief financial officer, Frank Wilcox, said in the earnings call.

“We continue to enhance our best-in-class claims infrastructure, which together with our reinsurance capabilities, serves to differentiate us from our peers,” Donaghy said. “The third quarter benefitted from strong and improving trends and I’m optimistic as I look forward.”

Donaghy’s rosy narrative raised a few questions in the Florida market Friday. A few insiders wondered how Universal can be so optimistic about the coming months, with Citizens Property Insurance Corp., the state-created insurer, continuing to undercut the primary market with it statutorily limited rate increases.

Universal officials did not return emails and phone calls seeking further information.

Universal’s stock price on Friday closed at $14.10 per share, down slightly from earlier in the day, and down from a high this year of $19.79, seen in April, according to Yahoo! Finance.

**Article obtained from: Insurance Journal, by William Rabb, Published 10/30/2023

https://www.insurancejournal.com/news/southeast/2023/10/30/746054.htm