In a twist on the “The Perfect Storm” account of a Massachusetts fishing boat getting caught out on the Atlantic Ocean as two fierce storm systems collided and produced monstrous waves, many Floridians are about to be broadsided by a pair of insurance rate increases.

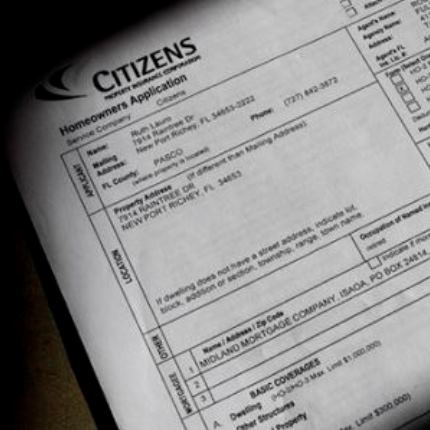

Some of those homeowners may not weather the impact as federal flood insurance premiums soar and Florida’s Citizens Property Insurance seeks state approval for increases in its policy rates.

Plus, health and automobile insurance companies are seeking Florida’s approval for rate increases, with some already authorized. Ouch.

The once delayed massive increases in National Flood Insurance Program rates are just beginning. The insurance tide began swelling on April 1 with premium increases on policy renewals.

Annual rate hikes of 9 percent to more than 20 percent should be expected. Low-lying homes in high-risk flood zones are the primary target for the largest increases, specifically the 20 percent of NFIP properties that have benefited from lower, subsidized premiums over decades.

Blame the Biggert-Waters Flood Insurance Reform Act of 2012, designed to back-fill the $23 billion debt carved into the National Flood Insurance Program (NFIP), after claims from Hurricane Katrina and Superstorm Sandy devastated the federal insurer. The act’s reasonable goal, to make the NFIP financially sound, becomes unreasonable by putting homeowners in jeopardy of losing their property to unaffordable premiums or forcing a sale.

Howls of protest led to congressional passage of the Homeowner Flood Insurance Affordability Act of 2014, but that law only delayed premium increases for two years. The reprieve has ended. Those real estate fears are very real again. Yet there is no groundswell of public opposition, no congressional movement on restraining rates. Yet is the key word. When homeowners begin receiving higher bills that promise to continue mounting, a broad outcry should be expected.

Owners of homes built prior to 1975 enjoy a federal subsidy and pay grandfathered low rates. Biggert-Waters attempted to eliminate those subsidies, but the Affordability Act wisely ended that threat. Florida would have been the hardest hit state with most subsidized policies. Primary homes are set to be billed about half of that. But those increases will occur for years. What can a property owner do?

Concerning the request for an average 6.8 percent premium increase from Citizens Property Insurance, very little if anything. Lobbying the state Office of Insurance Regulation is one way to express opposition. More than a decade without a hurricane matters not.

But Citizens counters that expensive water damage claims not connected to weather are surging, filed by contractors who assume homeowners rights and take advantage of this so-called “assignment of benefits” to inflate repair costs. When insurers deny claims, water mitigation companies file lawsuits, creating a cottage industry.

The Legislature failed to plug this public policy leak last session but must address it next year. The NFIP beast is not easily tamed, but options exist to mitigate premium increases.

NFIP premium increases could generate a seismic shift away from waterfront living for all but the rich. That should not be allowed to happen.