September 10 marks the statistical peak of hurricane season. Although Florida has escaped serious storms so far this year, we know that we have been lucky.

September 10 marks the statistical peak of hurricane season. Although Florida has escaped serious storms so far this year, we know that we have been lucky.

We did not feel so lucky in South Florida 22 years ago when Hurricane Andrew made landfall and became one of the largest natural disasters in U.S. history. Andrew transformed the way our state and country view hurricanes and how we insure ourselves to be able to recover from catastrophic damage.

After Andrew hit in 1992, the Florida Legislature passed a variety of laws to address issues brought on by the storm. Some of the measures were productive, some were meaningless, and others were down-right harmful to the property insurance market. In the years that followed the legislature would annually adjust the laws to address issues and cure problems. Things seemed to stabilize after about 10 years. In fact, the property market was functioning well enough to respond to eight hurricanes within the two year period from 2004 to 2005.

Following those storms, the Legislature once again felt compelled to act. So, in 2004, 2005 and 2006, lawmakers passed more property insurance legislation.

Many measures were approved under the guise of “consumer protection,” but were nothing of the sort. The market place may not be perfect all the time, but it has protected the consumers’ interests far better than government regulation.

Recognizing the importance of a market-driven approach, Gov. Jeb Bush signed legislation in 2006 based on the fundamental premise that each property owner should pay an insurance premium commensurate to the risk exposure of the property. That meant every property owner should pay his or her fair share and not ask others to pay more.

Then we had an election in November 2006, and our new leaders took an entirely different path.

These leaders believed that some Floridians needed the help of others to pay their property insurance bills. Unfortunately, they set up a Robin Hood-in-reverse program. The result was that one member of my family, with her six-figure salary and million-dollar home on Fort Lauderdale beach, received a $3,000 annual subsidy on her property insurance bill, while another family member, a working single mother of two on a five-figure salary living five miles from the beach, had the honor of paying higher prices for car insurance to subsidize family member number one.

Somehow, the idea that less-well-off Floridians should pay more on insurance so that affluent Floridians can pay less actually made all the sense in the world to some politicians.

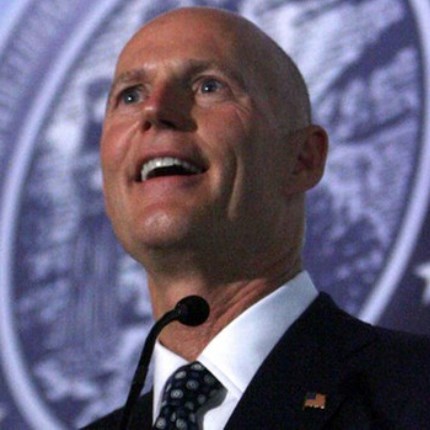

Four years later, Gov. Rick Scott interjected a modicum of reason to the situation. He challenged these subsidies, pointing out that they were not fair to working families. In addition, he wanted to address pervasive fraud and abuse issues in the property insurance market.

The Legislature responded in 2011 by passing a comprehensive reform package — better known in Tallahassee as SB 408 — redirecting the policy of our state once again.

The legislation established two priorities: First, it declared that fraudsters and hucksters must step aside and stop ripping off our consumers; Second, the legislation designed a path where every Floridian would pay for their fair share of property insurance, but not one penny more.

The 2011 legislation was based on the theory that free markets, not government regulation, best protects Florida consumers. This cornerstone American value has driven Florida’s property insurance public policy for the past four years, and it’s making a difference.

Florida has seen dramatic improvement in the property insurance market for the benefit of all consumers.

There is more work to be done, but things are heading in the right direction.

Florida is on a path where solvent, high quality companies all compete in a fairer marketplace to earn the consumers’ business, and where the consumer will find the best insurance product for the best price.

Source: SunSentinel