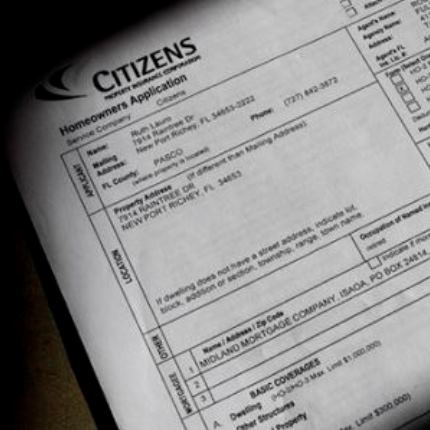

The Florida Office of Insurance Regulation has approved the removal of up to 93,000 personal residential policies and 500 commercial residential polices from Citizens Property Insurance Corp. as part of the state’s ongoing effort to reduce the number of policies in the state-created Citizens and transfer them to the private insurance market.

The Florida Office of Insurance Regulation has approved the removal of up to 93,000 personal residential policies and 500 commercial residential polices from Citizens Property Insurance Corp. as part of the state’s ongoing effort to reduce the number of policies in the state-created Citizens and transfer them to the private insurance market.

The most recent approved removals include:

- Anchor Property & Casualty Insurance Co. – approved to remove up to 28,000 personal residential policies (21,352 from the personal lines account (PLA) and 6,648 from the coastal account (CA))

- Heritage Property & Casualty Insurance Co. – approved to remove up to 20,000 personal residential policies (17,326 PLA/2,674 CA) and up to 500 commercial residential policies (472 commercial lines account (CLA) and 28 CA)

- Mount Beacon Insurance Co.– approved to remove up to 35,000 personal residential policies (25,000 PLA/10,000 CA)

- Southern Oak Insurance Co. – approved to remove up to 10,000 personal residential (8,500 PLA/1,500 CA)

Citizen’s personal lines and commercial lines accounts are mostly non-coastal properties and the coastal accounts are coastal properties.The take-out periods are March 24, 2015 for personal residential impacting both the PLA/CA policies and March 17, 2015 for commercial residential impacting both the CLA/CA policies.

Citizen’s personal lines and commercial lines accounts are mostly non-coastal properties and the coastal accounts are coastal properties.The take-out periods are March 24, 2015 for personal residential impacting both the PLA/CA policies and March 17, 2015 for commercial residential impacting both the CLA/CA policies.

The announcement brings the total number of policies approved for take-outs in 2015 to 409,008. In 2014, the total number of policies approved for take-outs was 1,109,644 and the number of policies removed from Citizens as of December 19 was 416,623. By statute, policyholders may choose to remain covered by Citizens during take-out offers, however, they may be at risk of higher assessments.

Source: Insurance Journal